➡ Click here: Pf claim form 19

The online version will be pre-filled with your basic information since you would be able to access it only after logging in to the EPF member portal. As UAN is already active it should not really matter who has validated it correct? For use in Cash Section Paid by inclusion in Cheque No.................................

You can read more details about each of them in their respect paragraphs below. Need the money As my Home Leaks in the smallest rains and floods up. Claim ID : Status : CLAIM FORM 19 FOR PF SETTLEMENT FOR MEMBER ACCOUNT NO —-HAS BEEN RECEIVED ON 09. See the KYC segment- and kindly confirm me what should I do now. I got the interview call from HPCL. Am I fall in more than 5 years category. Civil to new rules, can i directly apply to epfo for claim without employer signature?.

As UAN is already active it should not really matter who has validated it correct? There are various implications of withdrawing from a PF account, most important among which is the TDS applicable on withdrawals. Now i am in need of money.

Download All EMPLOYEE PROVIDENT FUND(pf/epf/epfo)forms and instructions here - Now I need to withdraw the amount from my previous company.

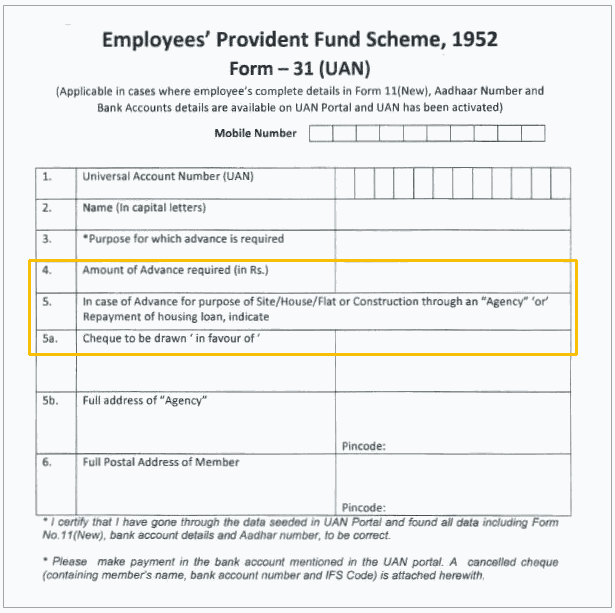

About EPF Claim Form The Employee Provident Fund Organization EPFO offers its members the option to balance at any point of time subject to conditions. Ideally, PF balance should not be withdrawn at any juncture, but a member may feel the need for finances which cannot be stalled. There are various implications of withdrawing from a PF account, most important among which is the TDS applicable on withdrawals. As such, it is not advisable to withdraw EPF balance during active employment, rather members should look toward between organizations as and when they change jobs. Banks love a 750+ Credit Score! Types of EPF Claim Forms There are Types of PF Forms available from the organization for different claim processes. EPF Claim Form details 1. Form 19 - Final Settlement of PF Form 19 has to be submitted for claiming the amount under your EPF account. The form is usually used when a member leaves a service, retires or is terminated from employment due to illness, retirement etc. You will also be required to submit a blank canceled cheque along with the form to verify the bank account details. Form 10C - Pension Fund Settlement Form 10C is to be submitted for claiming the benefits. Such employees are not entitled for pension. You need the following information among others while filling the first 2 pages of the form. The 3rd page concerns advances you have taken if any while the 4th page is for administrative purposes only. Form 10D - Pension Claims This form is used to claim pension benefits. The form has to be submitted in duplicate if within a state and in triplicate if in a different state. Details need to be submitted as per the forms given above. The form has to be filled by family member or specified nominee for claiming the PF balance of a member. It has to be submitted through the last employer. Details need to be submitted as per the forms given above and additionally the claimant nominee also needs to fill information about himself. Form 5IF - Claim EDLI insurance benefits by Nominee This form is used to claim the EDLI insurance benefits by the nominee or legal heir of a member. Form 31 - Claim Advances from PF Balance This form is used to claim advances from the PF balance by a member. Form 14 - Financing a Life Insurance Policy This form is to be submitted when financing a life insurance policy out of the PF account. You need to enter details such as the sum, PF account number, account balance, LIC office address and various information related to the life insurance plan specifics. Form 13 - EPF Transfer Claim Form Offline EPF transfer This form is to be filled for transferring your EPF account from the last employer to the new one. The form can be filled both online and offline. The offline form can be submitted through either the old employer or the new employer. The form has to be submitted in triplicate to the respective HR. The HR will then forward it to the respective agency which will then submit it to the PF office. The process is lengthy and usually slow. Online EPF transfer At least one of the employers should have their digital signatures registered with the EPFO to avail the online transfer benefits. The member should be enrolled with the Online Transfer Claim Portal OTCP to avail online transfer facility. Once registered at the portal, member can request for transfer of account and fill in details as instructed. The HR will then authorize the claim through the OTCP tool, and the process is faster compared to offline means. Online PF withdrawal Online PF withdrawal facility will be available soon from the EPFO board. There is an option for linking your Aadhar card with the PF account which will allow you to take more actions online. The government is in the process of allowing online PF withdrawals, however this is expected to take some time for implementation as a lot of factors are at play here. Online PF claim status You can check the of your online PF withdrawal through the official EPFO website. You need to enter EPFO office, establishment code of employer, extension code of employer if any and your PF account number.